Living cheaply doesn’t mean you have to eat plain rice for every meal or say goodbye to every little joy in life.

It just means being smarter with your money, cutting out the stuff that doesn’t matter, and finally breathing a little easier when the bills roll in.

I’m not here to tell you to stop drinking coffee or live off-grid. I’m here to SHARE real habits that make life cheaper without making it miserable.

Because let’s be honest—money stress is exhausting, and sometimes it feels like it just disappears into thin air, right?

“Beware of little expenses; a small leak will sink a great ship.”

Benjamin Franklin

If you’ve ever looked at your bank account and thought, “Where did it all go?”—this list is for you.

These are the tips I WISH I had when I first started getting serious about saving.

They’re practical, doable, and some of them? Surprisingly kind to your sanity.

So if you’re ready to save money in ways that actually fit your life, let’s do this.

No fluff. Just 35 money-saving habits to help you live cheaper—and feel better doing it.

What Is Cheap Living?

So… what does it actually mean to “live cheap”?

It’s not about being stingy, boring, or saying no to everything fun.

Cheap living is about spending less where it doesn’t matter—so you have more for the stuff that does.

For some people, that means shopping secondhand or cutting back on takeout.

For others, it’s moving into a smaller space or ditching subscriptions they forgot they had.

There’s no one-size-fits-all approach.

The cheapest way to live really depends on your lifestyle, your goals, and how much you’re willing to tweak your daily habits.

Here’s the thing: you don’t have to do it all at once. Even one small change—like planning your meals or using cash instead of cards—can make a difference fast.

Living cheaply just means being more intentional.

It’s not about doing without—it’s about doing more with what you already have.

And once you start seeing the results? It’s actually kind of addictive (in the best way).

You might also like: 50 Effortless Ways To Get Your Life Together

How to Live Cheaply: Best Cheap Living Tips

These aren’t vague ideas or recycled “skip your latte” advice.

These are real habits that make a noticeable difference—EASY enough to start today, and smart enough to stick with for the long haul.

1. Make a budget

I know, I know. You’ve heard this a hundred times.

But hear me out—a budget isn’t about restriction, it’s about clarity. When you know exactly where your money’s going, you stop guessing—and start saving.

You don’t need fancy spreadsheets or complicated apps either.

Just jot down your income, your bills, and what’s left. THAT’S where the magic happens.

2. Shop with a list and stick to it

Wandering the store “just to see” is a one-way ticket to spending $80 on things you didn’t need.

(Been there. Still have the random snacks to prove it.)

A list keeps you focused and out of the impulse aisle.

It’s one of the cheapest ways to live smarter—because you’re only buying what you actually planned for.

3. Cook more, eat out less

I’m not saying you have to become a chef overnight.

But if you can make a few go-to meals at home, you’ll save a serious chunk of cash over time.

Even something as simple as chili, pasta, or stir fry can save you $10–$20 every time you skip takeout.

Plus, leftovers are basically free food the next day. Just sayin’.

4. Buy generic when it makes sense

Name brands aren’t always better—sometimes they’re just better marketed.

Test out the store brand version of basics like pasta, cereal, or cleaning supplies.

You might be surprised how little difference you notice.

And hey, if you find something you really don’t like? You can always switch back.

But if you find 5 things that work just as well? That’s money saved without giving up anything.

5. Use what you have first

Before you run to the store, check your pantry.

Before you order that cute jacket, check your closet.

It sounds simple, but we forget how much we already own.

Sometimes the cheapest way to live is to press pause and ask: Do I already have something that’ll work?

6. Cancel subscriptions you don’t use

If you’re paying for five streaming services but only watching one… it’s time to cut the extras.

Same goes for forgotten app subscriptions or gym memberships you haven’t touched since January.

You can always re-subscribe later if you miss it. But for now? That’s money back in your pocket.

7. Try a no-spend day (or week)

Pick a day—or even a week—where you don’t spend money on anything that isn’t a true necessity.

It’s a great way to reset your habits and notice where your money usually goes.

Bonus: it’s a great excuse to use up what’s in your pantry or finally read that book you already own.

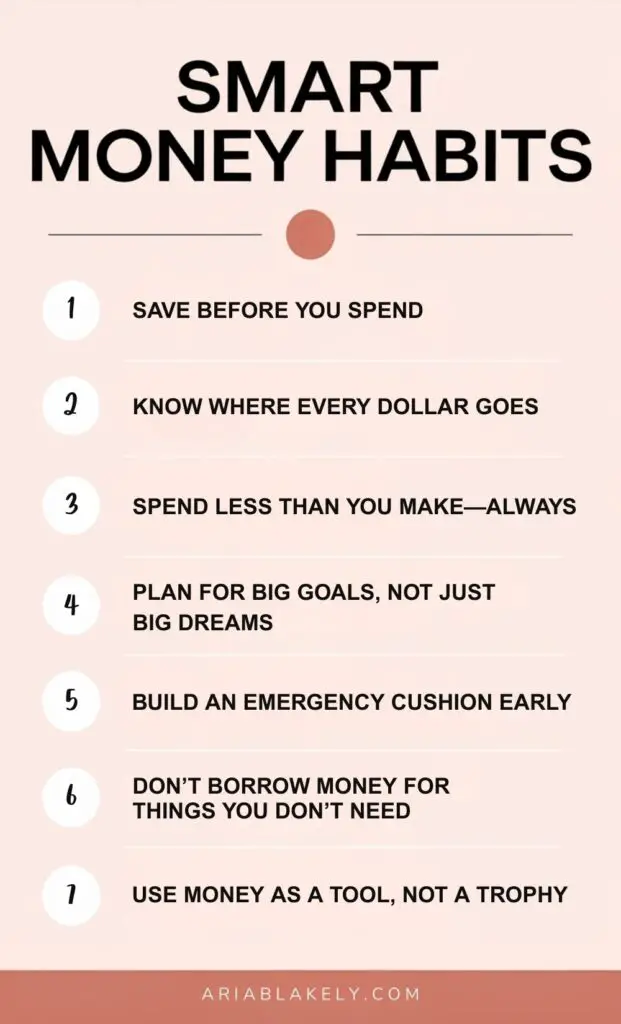

You might also like: 11 Smart Money Habits Of Women Who Are Never Broke

8. Use your local library

Books, audiobooks, movies, even online courses—libraries are packed with free resources most people totally forget about. All you need is a card.

You can even use apps like Libby or Hoopla to borrow digital content right from your phone.

Cheap, easy, and surprisingly fun.

9. Declutter and sell stuff you don’t use

Chances are, you’ve got at least a few things sitting around collecting dust—clothes, gadgets, decor, random kitchen appliances.

List them on Facebook Marketplace, Poshmark, or even have a quick garage sale.

You’ll clear space AND make a little cash on the side.

10. Walk or bike whenever you can

Not every trip needs to be by car.

If it’s close enough, walking or biking saves gas, parking fees, and wear on your vehicle—and it’s good for your body too.

Even switching up a few trips a week can make a difference (plus, no traffic!).

You might also like: 10 Simple Things Successful People Do On Weekends

11. Use cashback and deal apps

If you’re shopping anyway, you might as well get something back for it.

Apps like Rakuten, Fetch, and Ibotta give you cashback or points just for buying what you were already planning to buy.

I keep mine running in the background so I don’t even have to think about it—and yep, it actually adds up.

12. Cook in batches and freeze leftovers

One of the cheapest ways to live is to cook once and eat twice (or three times).

Make a big pot of something—soup, chili, pasta—and freeze extra portions.

It saves time, cuts food waste, and stops you from ordering takeout “just because there’s nothing ready.”

13. Compare prices before you buy

Before you click “buy now,” take 10 seconds to check another site—or even a local store.

You’d be surprised how often the same item is cheaper somewhere else.

Pro tip: Use browser extensions like Honey or Capital One Shopping to compare automatically.

14. Borrow instead of buying

Need a power drill for one afternoon? Or a fancy dress for one event?

Ask around before you drop cash on something you’ll use once.

Libraries, neighbors, friends, or even Buy Nothing groups are amazing for one-time-use stuff.

15. Make coffee at home

I’m not here to hate on your caffeine habit—but buying it out every day? That adds up fast.

Get yourself a cute mug and make it a ritual.

You’ll save $3–$5 a day without skipping your morning fix.

16. Meal plan every week

This one’s a game-changer.

Take 10–15 minutes each week to plan your meals around what you already have and what’s on sale.

It cuts down on food waste, SAVES you from those “what’s for dinner?” takeout moments, and helps you shop with purpose.

17. Buy in bulk (smartly)

Not everything needs to be bought in Costco-sized portions—but for pantry staples like rice, beans, oats, or toilet paper?

Buying in bulk often saves you BIG in the long run.

Just make sure you’ll actually use it before it goes bad. Otherwise, it’s not a deal—it’s just clutter.

18. Unplug appliances when not in use

Sounds small, but appliances still suck up energy when they’re just sitting there on standby.

Things like coffee makers, chargers, or the microwave clock? They’re sneaky little energy drains.

Unplug what you can. It’s one of those quiet habits that saves a few bucks every month—and those add up.

19. DIY gifts

Instead of dropping $50 on a last-minute gift, try something handmade or thoughtful: baked goods, a simple craft, a playlist, or even a heartfelt letter.

Cheap doesn’t mean thoughtless—and honestly, the HOMEMADE stuff always feels more personal.

20. Try generic medications

Most generic meds have the exact same ingredients as the brand-name version—and they can cost up to 80% less.

Talk to your pharmacist and don’t be afraid to ask if there’s a cheaper option that works just the same.

21. Learn basic DIY fixes

You don’t need to be a full-blown handyman to fix a leaky faucet, sew on a button, or patch up a scuffed wall.

YouTube is PACKED with tutorials that can save you a service call (and a big bill).

Every little repair you handle yourself adds up—not just in dollars saved, but in confidence too.

You start realizing, “Hey… I can do this.”

22. Switch to a prepaid phone plan

If you’re on one of those major cell phone plans, there’s a good chance you’re overpaying—especially if you’re not even using all the data they’re charging you for.

Prepaid and low-cost carriers offer solid coverage at a fraction of the cost.

And the best part? No surprise fees. Just check the coverage in your area and do a little math—you might be shocked at how much you’re overspending.

23. Rethink your transportation

Gas, maintenance, insurance, registration… cars cost a LOT.

If you can walk, bike, or carpool even a couple of times a week, you’ll notice the savings right away.

And if your area allows, try public transportation.

It’s not glamorous, but it works—and sometimes that’s ALL you need.

Living cheaply often means trading convenience for savings, and transportation is a big place where that trade can pay off.

24. Practice delayed gratification

You see something cute online. Your finger hovers over “add to cart.” Instead, you close the tab and wait 24–48 hours.

If you still really want it after that? Cool.

But most of the time, the urge fades—and you just saved yourself $30 on something that would’ve ended up forgotten anyway.

25. Use your time to make money (not just spend it)

Instead of scrolling, start creating.

If you’ve got a few spare hours each week, use them to sell handmade crafts, take surveys, write, pet-sit, or clean out your closet and list a few things online.

It doesn’t have to be huge.

Even $50–$100 extra a month can help you cover groceries or stash away for an emergency.

26. Say no to bottled water

Here’s a quiet budget leak a lot of people miss: bottled water.

It seems harmless—just a couple of bucks here and there—but it adds up fast.

Instead, invest in a good reusable bottle and a simple water filter for home.

You’ll save money, reduce waste, and never have to lug a case of plastic bottles again.

Small change, big impact.

27. Get comfortable with saying “No”

Sometimes saving money isn’t about what you do—it’s about what you don’t do.

You don’t have to say yes to every dinner invite, group trip, or trendy new product.

And you definitely don’t need to explain or apologize.

A simple “not in the budget right now” is enough.

Saying no today might be the reason you can say YES to something bigger tomorrow.

You might also like: How to Be That Girl

28. Use the library for more than books

Yes, libraries have books—but many also offer free access to digital courses, movies, audiobooks, community events, even Wi-Fi and printing.

You’re already paying for it through taxes, so why not use it?

It’s one of the most overlooked resources for saving money AND learning something new.

29. Choose multi-purpose products

Here’s a smart hack that’ll simplify your life and save cash: look for products that can do MORE than one thing.

Think shampoo that doubles as body wash, coconut oil that works as makeup remover and moisturizer, or household cleaners that can tackle multiple surfaces.

Buying fewer specialized products not only saves money, but also reduces clutter around your home (and who doesn’t love that?).

30. Look for free entertainment first

Before you buy concert tickets or movie passes, check for free events happening in your town.

Local parks, museums, outdoor festivals, or community centers often have free fun that doesn’t feel “cheap” at all.

You might be surprised at what’s happening just around the corner—without the price tag.

31. Plan vacations and trips

I get it—you deserve a break. But if you book vacations well ahead of time, or travel during off-peak seasons, you’ll score big SAVINGS on airfare, lodging, and attractions.

Check travel comparison sites, set price alerts, and be flexible on dates.

It’s the easiest way to enjoy more vacation for a lot less cash.

32. Skip paying full price

Before you buy something at full price, do a quick search online for discount codes or coupons.

Sites like RetailMeNot or apps like Honey and CouponCabin make it easy to save 10%, 20%, or even more—on stuff you’re already buying anyway.

Never check out without at least a quick look for a promo code.

You’d be surprised how often you’ll find one.

33. Share or split costs with friends

You don’t have to pay for everything alone.

Whether it’s sharing a streaming account, splitting bulk groceries, carpooling, or even swapping babysitting duties—pooling resources with people you trust makes life cheaper (and usually more fun, too).

It’s community saving at its BEST.

34. Go easy on your energy bill

Utility bills can drain your budget quickly.

But simple tweaks like turning off lights, switching to energy-saving bulbs, sealing drafty windows, or adjusting the thermostat slightly can make a noticeable difference.

Your wallet—and the planet—will thank you.

35. Keep an emergency fund

Maybe this isn’t a tip to “save money” directly, but it’s about keeping you from spending even more in the long run.

Having even a small emergency fund means you won’t have to panic when life happens—a flat tire, sudden medical bills, or job loss.

Start small: even $20 per paycheck adds up.

It’s your personal safety net—and trust me, it’ll feel amazing when you finally need it.

You might also like: 100 Positive Habits To Create An Epic Life

For You

If you’ve made it this far, first off: THANK YOU for sticking around.

I know that was a lot to take in—but I promise, even if you just pick a few of these ideas to start with, you’ll notice a difference.

Here’s the thing about living cheaply—it’s not about losing anything important.

It’s actually about getting MORE of the stuff that truly matters: less financial stress, fewer sleepless nights, more freedom to say yes to things you genuinely love.

Cheap living isn’t about feeling deprived; it’s about feeling in control.

It’s empowering to know exactly where your money is going, and even more exciting to watch it stay in your pocket instead of disappearing without a trace.

You might also like: Glow Up Challenge: 20 Powerful Ways to Glow Up Your Life

You deserve financial peace. You deserve freedom from worrying about bills.

And most importantly, you deserve to FEEL good about the way you live, spend, and save.

Now go ahead and choose one or two tips to try this week. I’d love to hear from you! 💛